With the rise of the WFH (Work from home) movement, accelerated in part due to COVID-19, more and more people are moving towards digital means of communication.

In response, organisations are (or should be) analysing customer conversations to find business growth opportunities. Within these communications are goldmines of growth opportunities for your business.

But, how do you extract it?

Having been in the Conversational AI space for the last 15+ years, I’d like to say I’ve figured out some tricks in that time. As a big advocate for education, I’d like to share some of these.

We’re diving into the world of conversation analysis to highlight 3 crucial stages of analysis, and a few tools to get the job done. If you want to skip to the tools, click here.

Stuck on what text analysis tool is best for your usecase? Try this 2 minute quiz →

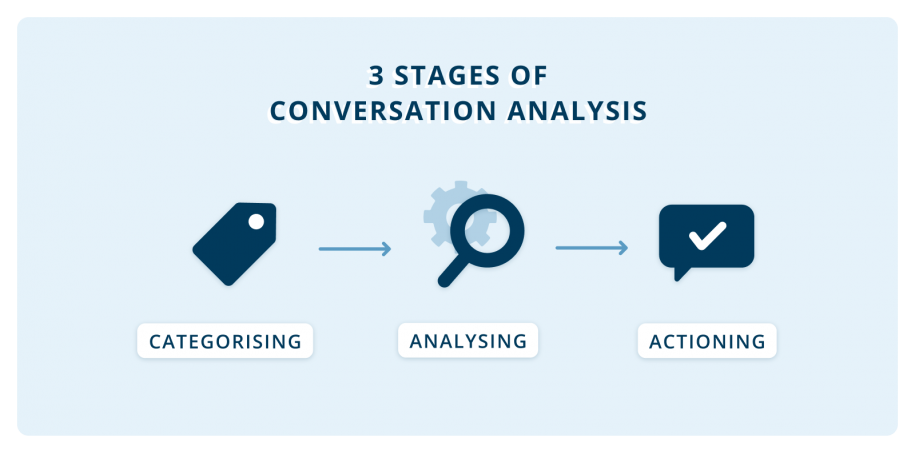

3 Stages of Conversation Analysis

The conversation analysis journey is split into 3 stages: the categorising, analysing and actioning stages. Of course, this is assuming that your conversational data (social media, emails, support tickets, live chat, phone transcripts etc.) has already been collected and cleaned.

Stage 1: Categorising

Assuming your data import process has gone through various ‘data cleansing’ activities, the first stage in conversational analysis is categorising your customer communications.

Categorising, or “tagging” as some platforms call it, is the process of assigning meaning or intents to the components of an utterance .

Take this sentence: “I want to buy an apple, and sell my banana.”

Here, there are two intents: buyApple and sellBanana. Easy, right? As an intelligent human being, this is a piece of cake. Unfortunately, many commercially available analysis tools will try to assign just one intent to this sentence, so the end result may just be buy[Apple] OR sell[Banana].

Most solutions will actually try to do this to a whole paragraph of text should the user have several utterances in a single message. Then, it’s like a game of intent roulette to see which one the tool chooses as the single most important intent – assuming it can extract relevant information in the first place.

That’s why, when categorising, I always recommend a “human in the loop” approach. While it requires more human intervention, the rewards reaped from this initial investment into conversation categorisation ensures there are no embarrassing mistakes in customer trend analysis or chatbot conversations.

The categorising stage is arguably the most important stage in the whole process. Though it takes up the most time, categorising communications well will set up accurate and meaningful data for the rest of the stages.

Pro Tip 1: During the categorisation process, there should be someone from each team that would benefit from understanding customer communication trends. I see many organisations task their front-line employees with categorising conversations out of convenience. However, they’re not always aware of what marketing, product, IT or other teams value from these interactions. Having a conversation stakeholder from each team ensures value is maximized and used across the organisation.

Stage 2: Analysing

The second stage is about finding the trends in your customers’ communications. Meaningful trends may not always be obvious, which is why there is a need to have people from different disciplines during the categorisation and analysis stages.

Pro Tip 2: If you used an AI / machine learning approach to categorisation, note that your ability to analyse topical trends is limited to the original set of labels you assigned in your training data. If you find that your labels aren’t specific enough during analysis, you have to go back and re-categorise. If re-categorisation is not done, the data is inaccurate and unusable for company growth.

When analysing, I approach the task with an 80/20 view. I find that just 20% of intents or categories will provide me deep insight and next best actions for 80% of what customers talk to you about.

Here’s a short list of my first steps:

- Focus on the top 80% – maximizes efficiency and covers the most important bases and actionable insights.

- Look for cases where not enough information has been provided – these are the types of communications you can quickly automate with followup questions.

- Explore the long tail – for analysis, these unique and complex long-tail communications are less effective to create meaningful growth, but they can be better enhanced by cross-analysis with other customer data.

It’s always best practice to cross-analyse your communication with other sources of customer data. While analysis gets more complex, it becomes increasingly valuable.

Read: How to select the right NLP tool for your customer experience needs

Stage 3: Actioning

The third stage is about making the insights gathered from the analysis useful.

While what actions are considered useful may differ depending on your role, there is no doubt about the value of conversational analysis – insights straight from your customer’s mouth.

How do you make these “insights” into golden nuggets?

Here are some examples:

- Customised reporting – customer communication data visualized exactly to your organisation’s needs and has views for all teams involved

- Advanced communication allocation – beyond basic routing (e.g. service enquiries forwarded to the service team), service communications that relates to product team priorities, but also has points of interest for marketing teams can be distributed to each team, allowing data to work more productively across the organisation

- Resource allocation – Redirecting resources or restructuring your organisation to adapt and resolve the top issue/trending conversations

- Development prioritization – using most common issues raised about your product for prioritizing features in the next update

- New segment identification – Identify customer segments that were previously buried beneath tonnes of conversations (e.g. customers who have typically asked these questions, and have also done X,Y and Z spend 10% more than the average, or are 20% more open to upsells)

- Decrease employee time on low-value tasks – automate pre-canned responses, point customers to existing resources or engage a bot, uplift employee engagement while reducing churn and retraining of your team

- Build a strong base for machine learning – categories, intents and labels curated through this process can feed into machine learning projects fuelled by your customer’s needs

Click through here for more team-specific usecases

- Marketing use cases for conversation analysis [Give it a go]

- Customer service use cases [Give it a go]

- Chatbot team use cases [Give it a go]

Analysing customer conversations gives you the power to act, and not react to issues and trends before they escalate. More often than not, there are also growth opportunities that haven’t been discovered because of analysis paralysis.

So, the next section is about finding the right tools for your organisation to be rid of conversational analysis paralysis and be on top of using customer conversations as levers of growth.

Related: 6 Steps for a Winning Voice or Chatbot Channel Strategy

Conversation Analysis Tools for 3 Stages of Conversation Needs

The Beginner Trio

- Your CRM

- Excel

- Social Listening Tools

You’d be surprised how many large companies are still using a mixture of their current tools and MS Excel for analysis of communications. No doubt, this is a quick way to start analysing, but it is not scalable in the long, or middle run.

If you’re at this stage, my advice is to quickly understand what it is that you want out of conversation analysis, and what you need in an analysis tool. Then, upgrade to that tool as soon as you can. The benefits are boundless. Hundreds of hours saved from categorisation (and often, recategorisation), deeper, more meaningful insights from a much more powerful analysis process, as well as faster business response for cost reduction or revenue generation.

The “Best Practice” Tools

- Google NLP Products – AutoML and Natural Language API

- Amazon Comprehend

- Watson Natural Language Understanding

- Azure Text Analysis API

A lot of large organisations use these tools with their conversational analysis, and rightly so. They are easy, powered by generic NLP that works across all sectors, industries and teams.

A big down-side to many of them is that they mostly play well with their suite of products, and require expensive customization, resources and training to mingle with other technologies you have in your enterprise landscape. Then things get expensive really quickly.

Depth of analysis-wise, they’re able to pick out the elements in utterances well, but I tend to find that they are too generic for deriving useful and meaningful value to make revenue-generating actions on.

Don’t take my word for it, you can try out Google and Azure demos on their landing page. Insert a piece of conversation, and see the results for yourself. How well do they extract relevant and specific information to drive productive action for your organisation?

This brings me to the third category.

The “Deep Dive” Tools

These are tools that provide more substance and meaning to your customer communications. They seek to understand conversations, all their patterns and nuances in order to provide valuable, actionable and meaningful insights.

Another reason why I prefer these tools is because they are flexible. They are unattached to a particular suite of products. Enterprises already have such complex technology landscapes. There is no need to add another tool that doesn’t play well with others.

Hope this has helped you. If you know someone who can benefit from this article please share it with them!

If you’re still having trouble finding the best tools or criterias to assess tools and vendors, try the quiz below 🙂.